[ad_1]

Sundry Pictures/iStock Editorial by means of Getty Images

Over and above Meat (NASDAQ:BYND) is my favorite plant-based vegan stock in a speedy-growing market that will transform the way we take in and treat animals.

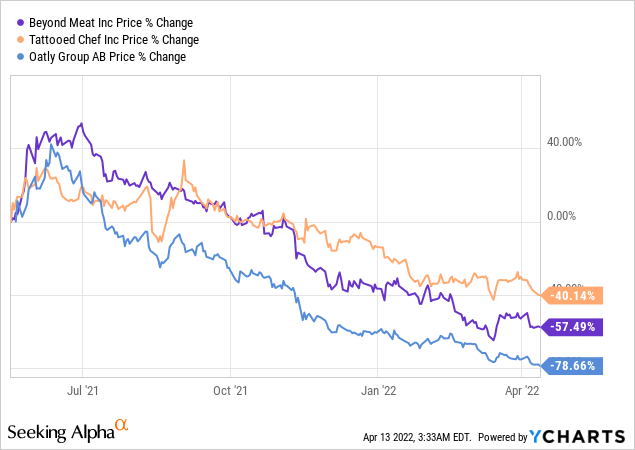

Nevertheless, vegan shares have been certainly crushed more than the past 52 weeks and several huge names are down as substantially as 80%.

Increasing inflation, larger bond yields, and substantial overvaluations based on greed have caused these firms to slide off a cliff inspite of a bullish prolonged-phrase outlook for the plant-based meat and milk business.

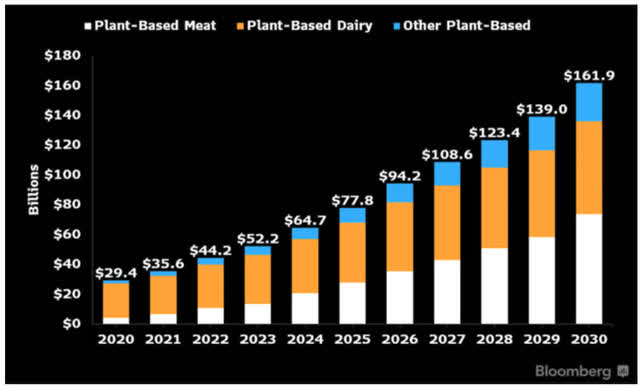

According to FoodBusinessNews.internet, the plant-dependent foodstuff field could grow 5x to $161 billion by 2030.

2030 Plant-Centered Food items Field Expansion (Foodbusinessnews.net)

As the world populace grows more substantial, it really is getting extremely hard to feed the overall world using the aged classic animal-based mostly meals pyramid.

Plant-centered meat and milk organizations will disrupt the whole foods industry by offering more healthy solutions to meat and dairy. In accordance to Vox, plant-centered food items are also improved for the atmosphere by consuming significantly less h2o and manufacturing decrease Co2 emissions.

Out of the lots of decisions offered to traders, I select Over and above Meat as a obvious winner and will give my insights on why I’m nonetheless bullish on BYND shares.

Outside of Meat Finished 2021 with Nearly 50 % a Billion in Income

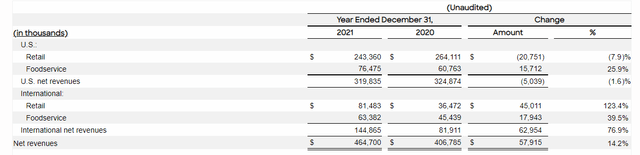

In 2021, Over and above Meat documented once-a-year income of $467 million (Up 14.7% YoY) with a net decline of $187 million (-$2.88 for every share).

The excellent news is that Further than Meat has a ton of new solutions in the pipeline along with several partnerships with major organizations like McDonald’s (MCD) and PepsiCo (PEP).

Further than Meat introduced the McPlant burger nationwide in the Uk and in minimal areas in the United States. It seems that the McPlant carried out much improved in Europe even though US product sales have been underperforming.

Lately, the business released a new retail merchandise called Over and above Meat Jerky and expanded the distribution of its meatless rooster nuggets merchandise.

In the Q4 2021 quarterly report, Beyond Meat CEO Ethan Brown talked a large amount about how the firm was dealing with declining US profits when revenue enhanced internationally YoY.

Outside of Meat Comprehensive Yr 2021 Revenue Numbers (BeyondMeat.com)

The issue is that only 10% of Individuals don’t eat meat while most are loyal to the common American food plan. The superior news is Beyond Meat will launch many items this 12 months to encourage additional People in america to give them a test.

Intercontinental profits keep on being potent, and I anticipate this craze to carry on perfectly into 2022.

Beyond Meat Continues to be the Top rated Pet dog of the Plant-Primarily based Meat Industry

I’m however bullish on Past Meat to direct the plant-centered alternative meat field in the upcoming.

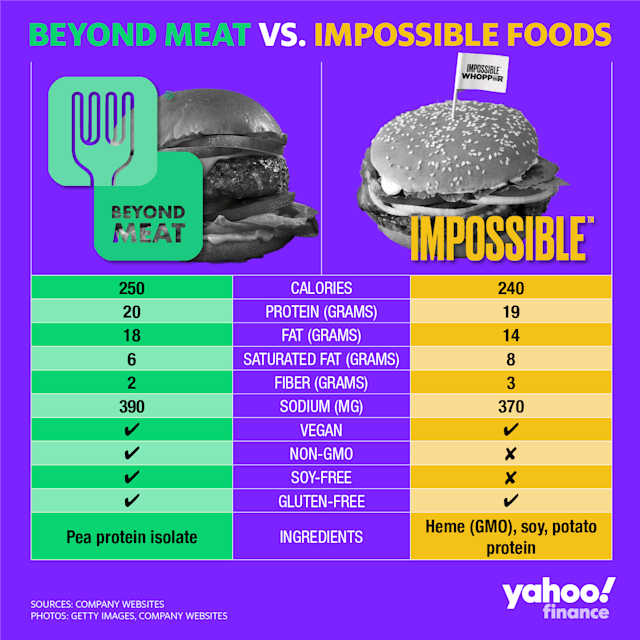

Outside of Meat’s items are normally more expensive and include less saturated excess fat and far more protein.

For illustration, Extremely hard Meals distributes its plant-dependent burger in partnership with Burger King, however investigate demonstrates that Past Meat is by much the healthier option.

Over and above Meat vs Not possible Meals (Yahoo.com)

According to EverydayHealth, there are several health positive aspects to adopting a plant-based diet, like body weight loss, increased psychological clarity, and a a lot more youthful appearance.

Meatless alternatives take in much considerably less drinking water and generate fewer Co2 emissions. More men and women will embrace a plant-based life style as soon as they practical experience the wellbeing rewards for by themselves and Further than Meat is the very clear innovator in this new nevertheless fascinating field.

Danger Factors

Levels of competition from plant-based food stuff firms is arguably the largest danger factor at the minute.

Not possible Meals sells similar solutions at more cost-effective charges and now signed a multi-calendar year partnership with Burger King. However, the firm founder just lately stepped down as CEO because of to a delayed IPO.

There are other plant-based food items competition this kind of as Tattooed Chef (TTCF) and Quite Very good Food items Enterprise (VGFC) that could steal industry share in the future. These firms can build loyal followings with their solution choices and persuade Outside of Meat consumers to make the change in the long run.

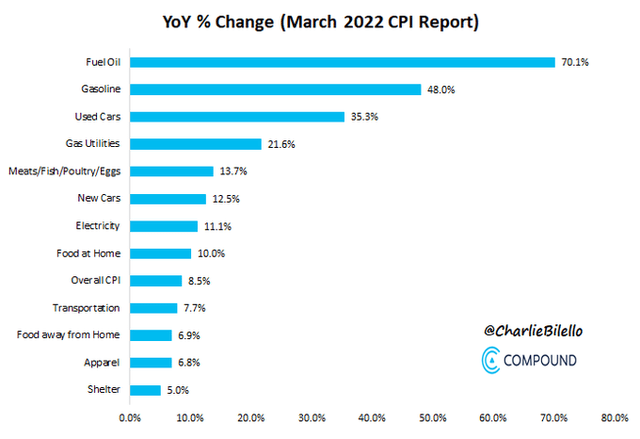

Pricing could also scare people away thanks to greater inflationary concerns. March 2022 CPI details pegged inflation at 8.5%, while foodstuff value inflation was approximated at 10%.

March 2022 CPI Inflation Information (CompoundAdvisors.com)

A large amount of people could reach for cheaper foodstuff solutions to guard them selves from inflationary pressures.

Yet another main threat aspect is dollars melt away, though Further than Meat invests intensely in R&D additionally distribution. The corporation has but to change a gain and has an accumulated deficit above $500 million. In March 2021, Outside of Meat lifted approximately $1 billion as a result of a convertible take note sale and these notes will experienced on March 15th, 2027.

Further than Meat continues to rack up bigger losses as the company aims for speedy profits development. The enterprise has $733.3 million in cash but could little by little burn off as a result of its reserves around the subsequent handful of yrs.

Last of all, short sellers carry on to wager versus the organization and now Over and above Meat has a 39% brief curiosity. In actuality, Past Meat is a single of the most shorted stocks on Wall Road.

As extensive as the shorts are crushing the stock, I wouldn’t be amazed to see Over and above Meat inventory dip below $40 or even tactic the $25 amount.

There is a lot more draw back possibility at these stages, so will not assume BYND shares have bottomed currently.

Conclusion

I think Further than Meat CEO Ethan Brown is a visionary that needs to change the way we handle animals all-around the entire world.

BYND stock is a bit risky now, and I fully grasp why several investors are betting towards this enterprise because of to its slipping inventory price. On the other hand, if you think very long term, then this could be a terrific possibility to average down or acquire the dip.

With just beneath a $3 billion sector cap, Over and above Meat is the upcoming frontrunner and could be a 10x stock that gets talked about in the decades to come.

[ad_2]

Supply url